Introduction

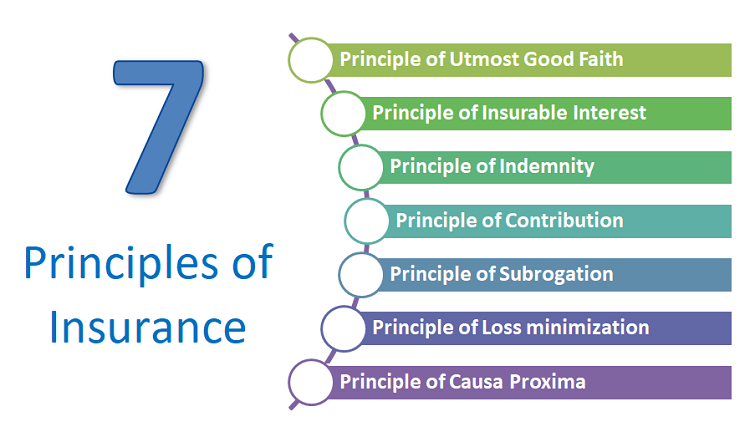

Insurance is an essential aspect of our daily lives. From insuring vehicles, homes, and businesses to protecting ourselves from health risks and uncertainties, insurance serves as a safety net in times of crisis. However, like any other industry, the world of insurance has its own set of laws and regulations that govern it. As such, understanding the principles that underpin these rules can be beneficial when dealing with insurance matters. In this blog post, we’ll explore some major principles of insurance law so you can have a better grasp on how your policies work!

The Principle of Insurable Interest

The Principle of Insurable Interest is a fundamental principle in insurance law that requires the person seeking insurance to have an insurable interest in the subject matter of the policy. In simpler terms, it means that you must have something at stake before you can insure it.

This principle ensures that insurance policies are not used for gambling or speculative purposes. It also prevents people from taking out insurance policies on things they do not own or have no relationship with.

An insurable interest can be either a financial interest or a legal interest. For example, if you own a car, then you have a financial interest in it and can insure it against damage or theft. If you are leasing a car, then you may not technically own it but still have an insurable interest because you are responsible for its care and maintenance.

Insurable interests can also extend beyond property to include personal relationships. For instance, parents might take out life insurance policies on their children as they would suffer financially if something were to happen to them.

The Principle of Insurable Interest ensures that both parties involved in an insurance contract benefit from its existence while preventing fraudulent claims from being made.

The Principle of Utmost Good Faith

The Principle of Utmost Good Faith is a fundamental principle in insurance law that requires both the insurer and the insured to act with honesty, integrity, and transparency when dealing with each other. This principle applies to all types of insurance contracts, whether it be for life, property or liability insurance.

For insurers, utmost good faith means providing complete and accurate information about the terms and conditions of an insurance policy to potential clients. Insurers must also disclose any relevant facts that may affect a client’s decision to purchase their product.

On the other hand, for policyholders or insured individuals, utmost good faith means disclosing all pertinent information about themselves when applying for coverage. This includes informing insurers about any past claims filed by them or if they have pre-existing medical conditions.