Introduction:

As the cost of higher education continues to rise, student loan debt in the United States has reached an alarming milestone, surpassing $2.5 trillion. This burgeoning debt burden has ignited a heated debate on the feasibility and necessity of implementing student loan forgiveness programs. While some argue that forgiving student loans could alleviate financial hardships for millions of borrowers, others raise concerns about the potential economic implications and fairness of such measures.

Student Loan Debt Crisis Reaches Record High:

The student loan debt crisis has been a growing concern in recent years, with the outstanding debt now exceeding $2.5 trillion. This represents a significant burden for millions of borrowers who struggle to make monthly payments, hindering their ability to achieve financial stability and invest in other areas of their lives, such as homeownership and retirement savings.

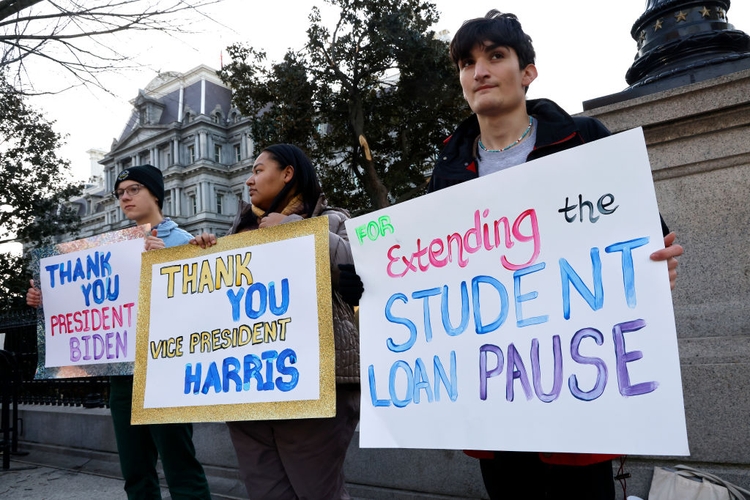

Calls for Student Loan Forgiveness:

Amid the growing crisis, there have been mounting calls from various stakeholders, including politicians, advocacy groups, and borrowers themselves, to implement widespread student loan forgiveness programs. Proponents argue that forgiving student debt would provide much-needed relief to borrowers, stimulate economic growth, and bridge the wealth gap by enabling individuals to invest in their futures and contribute to the economy.

The Debate on Economic Implications:

Critics of student loan forgiveness raise concerns about the economic implications of such a move. They argue that writing off trillions of dollars in debt could have adverse effects on the federal budget, lead to tax increases or inflation, and potentially weaken the financial sector if student loan lenders face significant losses.

Political Landscape and Legislative Proposals:

The issue of student loan forgiveness has become a hot topic in political debates, with policymakers and presidential candidates proposing various plans to address the crisis. These proposals range from targeted debt relief based on income to complete loan forgiveness for all borrowers. The debate is often deeply divided along party lines, making it challenging to reach a bipartisan consensus.

Impact on Borrowers and Future Students:

The student loan debt burden not only affects current borrowers but also impacts the decisions of prospective students. High levels of debt may deter some individuals from pursuing higher education altogether or lead them to choose more affordable options, potentially affecting the nation’s future workforce and economic competitiveness.

Alternative Solutions:

As the loan forgiveness debate intensifies, some advocate for alternative solutions to address the student debt crisis. These proposals include reforming the student loan system, implementing income-driven repayment plans, improving financial literacy, and investing in education affordability measures to reduce the need for excessive borrowing in the first place.