Introduction:

The insurance industry has historically played a pivotal role in mitigating financial losses caused by various risks, including natural disasters and climate-related events. However, the escalating frequency and severity of such events due to climate change have prompted the insurance sector to adapt and innovate in order to effectively manage these risks. This article explores how the insurance industry is evolving to address climate-related challenges and provide comprehensive coverage to individuals, businesses, and communities.

Understanding Climate-Related Risks:

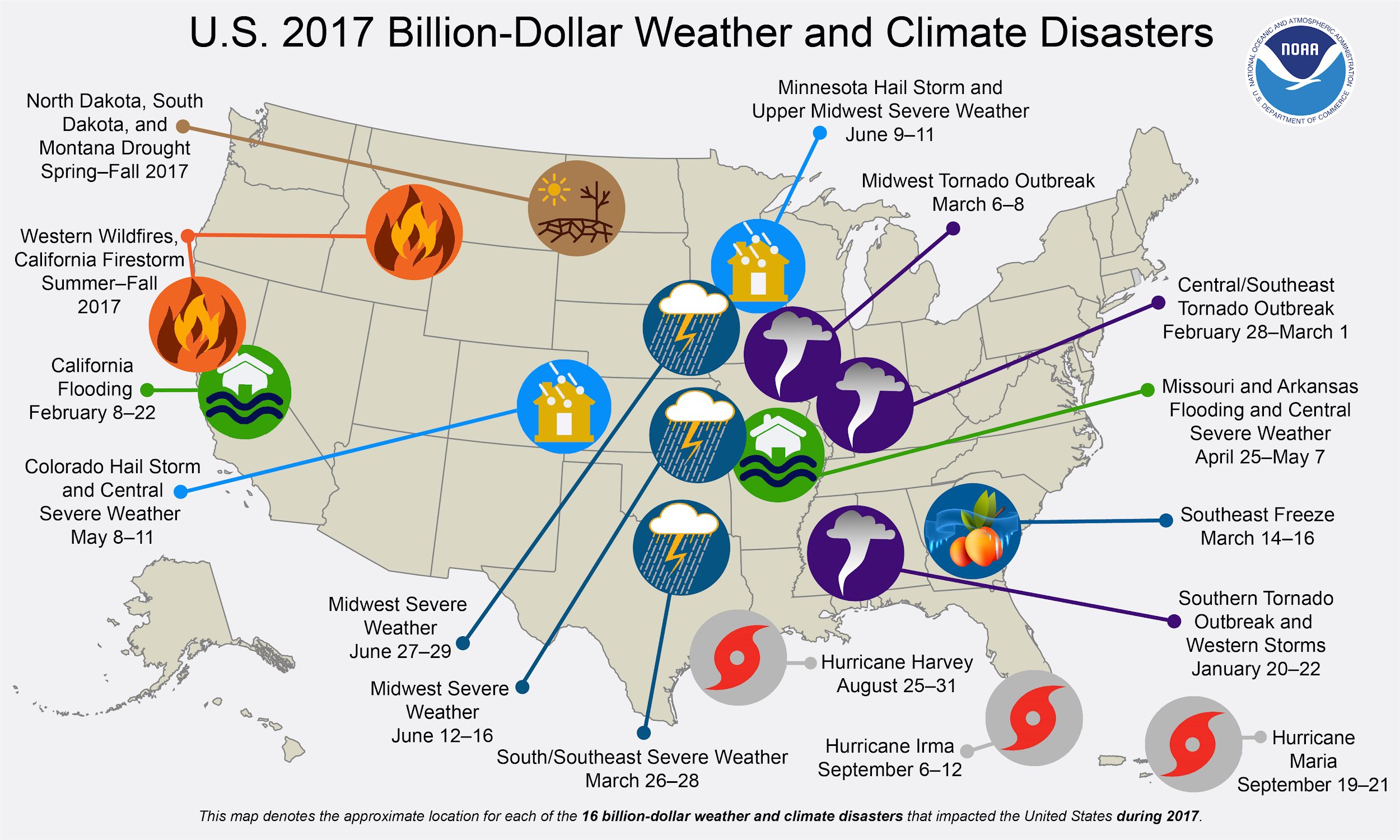

With the increasing occurrence of extreme weather events such as hurricanes, wildfires, floods, and droughts, insurance companies are reevaluating their risk assessment models.

Advanced data analytics and modeling techniques help insurers better predict and quantify the potential losses associated with climate-related events.

Incorporating Climate Data into Risk Assessment:

Insurers are leveraging climate data and historical weather patterns to refine their underwriting processes.

Geographic information systems (GIS) and remote sensing technologies provide valuable insights into vulnerability hotspots, aiding insurers in pricing policies more accurately.

Offering Specialized Coverage:

As the risk landscape evolves, insurers are developing specialized coverage options for climate-related risks.

Parametric insurance policies, which pay out based on predefined triggers like wind speed or rainfall levels, are gaining popularity for their faster claims processing.

Encouraging Resilience and Risk Mitigation:

Many insurance companies are incentivizing policyholders to adopt risk mitigation measures to reduce potential losses.

Discounts or lower premiums are offered to individuals and businesses that take steps to safeguard their properties against climate-related risks.

Investing in Sustainability:

Insurers are increasingly integrating environmental, social, and governance (ESG) considerations into their investment strategies.

Some insurance companies are divesting from industries contributing to climate change and investing in renewable energy and sustainable infrastructure.

Public-Private Partnerships:

Collaboration between governments, insurance companies, and other stakeholders is becoming crucial in managing climate-related risks.

Public-private partnerships facilitate the sharing of risk and resources, enabling faster recovery after disasters.

Education and Awareness:

Insurance companies are educating consumers about the importance of climate-related coverage and risk awareness.

Increased public awareness helps individuals and businesses make informed decisions regarding insurance coverage and risk management.

Regulatory and Reporting Changes:

Regulatory bodies are beginning to require insurers to disclose their exposure to climate-related risks and their strategies for managing these risks.